Keva, which is responsible for the funding of local government pensions and the investment of pension funds, reported a total return of 15.8% or a record EUR 9.1 billion on investments at market value for 2021.

Of Keva’s investment assets, the best performers were private equity investments at 48.3%, listed equities at 19.9% and hedge funds at 17.3%. The return on real estate investments was 9.6% and fixed income investments 1.4%.

Keva’s investment assets had a market value totalling EUR 66.8 billion at year-end 2021. Of this, listed equities accounted for 35.8%, fixed income investments (including the impact of derivatives) for 35.8%, private equity investments (including unlisted equities) for 16%, hedge fund investments for 6.4% and real estate for 6.0% of risk-based distribution.

”Investment performance was exceptionally good. It was driven by strong growth in global stock markets and successful allocation choices,” Keva CEO Jaakko Kiander notes.

The return on private equity investments, excluding unlisted equities, was 51.4% in 2021. CIO Ari Huotari says that this was driven by strong economic growth, the very good financial development of investees and a record number of breakaways. On top of which, valuation levels were up and the market was marked by a strong sense of optimism.

“The good return on private equity investments is the result of systematic work. The portfolio has been constantly and determinedly built up since back in the 1990s. For example, the average return on private equity investments over the past 10 years is 17.2%,” Huotari says.

Huotari considers that a successful strategy and adequate diversification combined with high-quality, responsibly-operating asset managers creating added value, are the basis for good performance. Headed by Senior Portfolio Manager Markus Pauli, the small, cohesive private equity investments team has boldly developed investment operations and challenged old business models.

“We now have a good quality private equity investment portfolio, which withstands various market conditions and which we can continue to expect to perform well,” Pauli says.

The year currently underway is marked by exceptionally great uncertainty.

“At the time of writing, the geopolitical situation in Europe is highly uncertain. A set of circumstances, which at worst could erupt into military intervention, is causing concern on the markets. At the same time, the effects of global inflation on the actions of central banks and thus interest rates are being considered. Nor should it be forgotten that earlier actions by central banks have inflated risky markets to record levels,” Ari Huotari points out.

Excellent result also long term

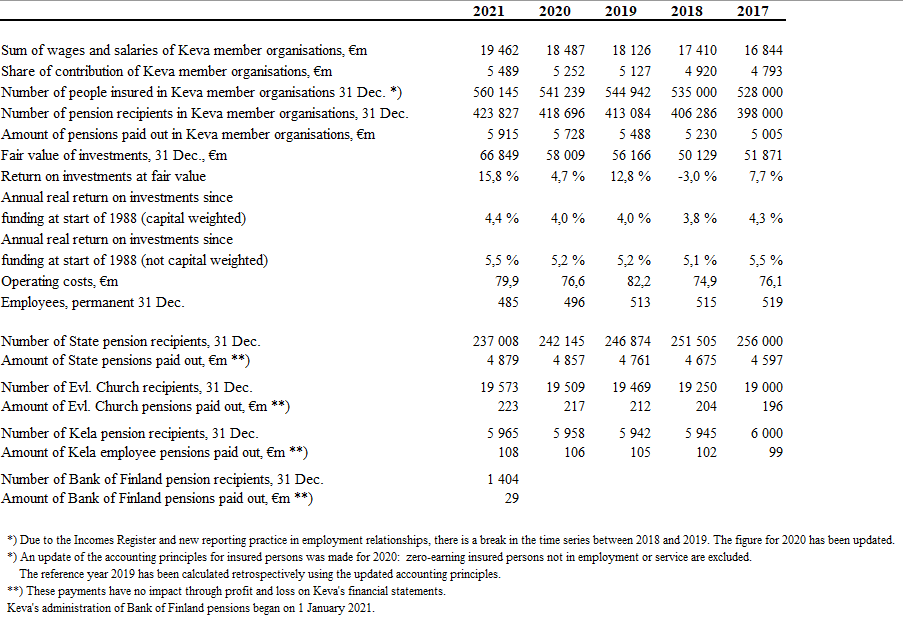

Keva’s long-term return on investments has been excellent. The cumulative capital-weighted real return in investments since funding began in 1988 to year-end 2021 was 4.4% a year. The average real return, excluding capital weighting, over the same period was 5.5%. The Finnish pension sector normally calculates long-term returns excluding capital weighting. Keva’s five-year real return excluding capital weighting has been 6.1% (nominal return 7.4%) and the ten-year return 6.6% (nominal return 7.8%).

Rapid growth in sum of wages and salaries in local government sector

The sum of wages and salaries of Keva member organisations – towns and cities, municipalities, joint municipal authorities and municipal limited liability companies – grew by a total of 5.3% in 2021. The sum of wages and salaries paid in the public sector grew in consequence of the increased need for human resources in healthcare because of the pandemic. A total of EUR 5.7 billion in contribution income accrued. Keva paid out EUR 5.9 billion in local government pensions. The difference between contribution income and pension expenditure was met out of investment income.

In 2021, Keva paid out pensions totalling EUR 5.2 billion to State, Evangelical Lutheran Church, Social Insurance Institution of Finland (Kela) and Bank of Finland personnel. Keva assumed responsibility for administering the pension coverage of Bank of Finland employees from the beginning of 2021. The State, Church, Kela and Bank of Finland fund their own pensions and Keva’s investment assets are used solely to provide local government pensions.

Fall in number of persons retiring on full disability pension

In 2021, Keva received a total of almost 65,000 pension and benefit applications. Processing times of all pension benefits were shorter or remained unchanged compared to the previous year. The percentage of electronic applications grew in particular in disability pensions and rehabilitation applications. Around 57% of all pension applications were made electronically through the Keva My Pension service. The customer satisfaction of pension applicants remained at an excellent level.

The number of persons taking partial disability pension remained at the same level as a year earlier. The biggest changes emerge in the review between pension benefits. There were almost 10% fewer people retiring on full disability pension than a year earlier.

“The start of disability pension during the corona period has surprisingly reduced. It remains to be seen whether this I s a permanent change,” Jaakko Kiander reflects.

Key figures 2021

The figures in this release are preliminary and have not been subject to audit.

Keva’s financial, interim and annual reports are published at https://www.keva.fi/en/this-is-keva/financial-information/.

The Report of the Board of Directors and the financial statements will be published on our website after the meeting of Keva Councillors on 9 March 2022.