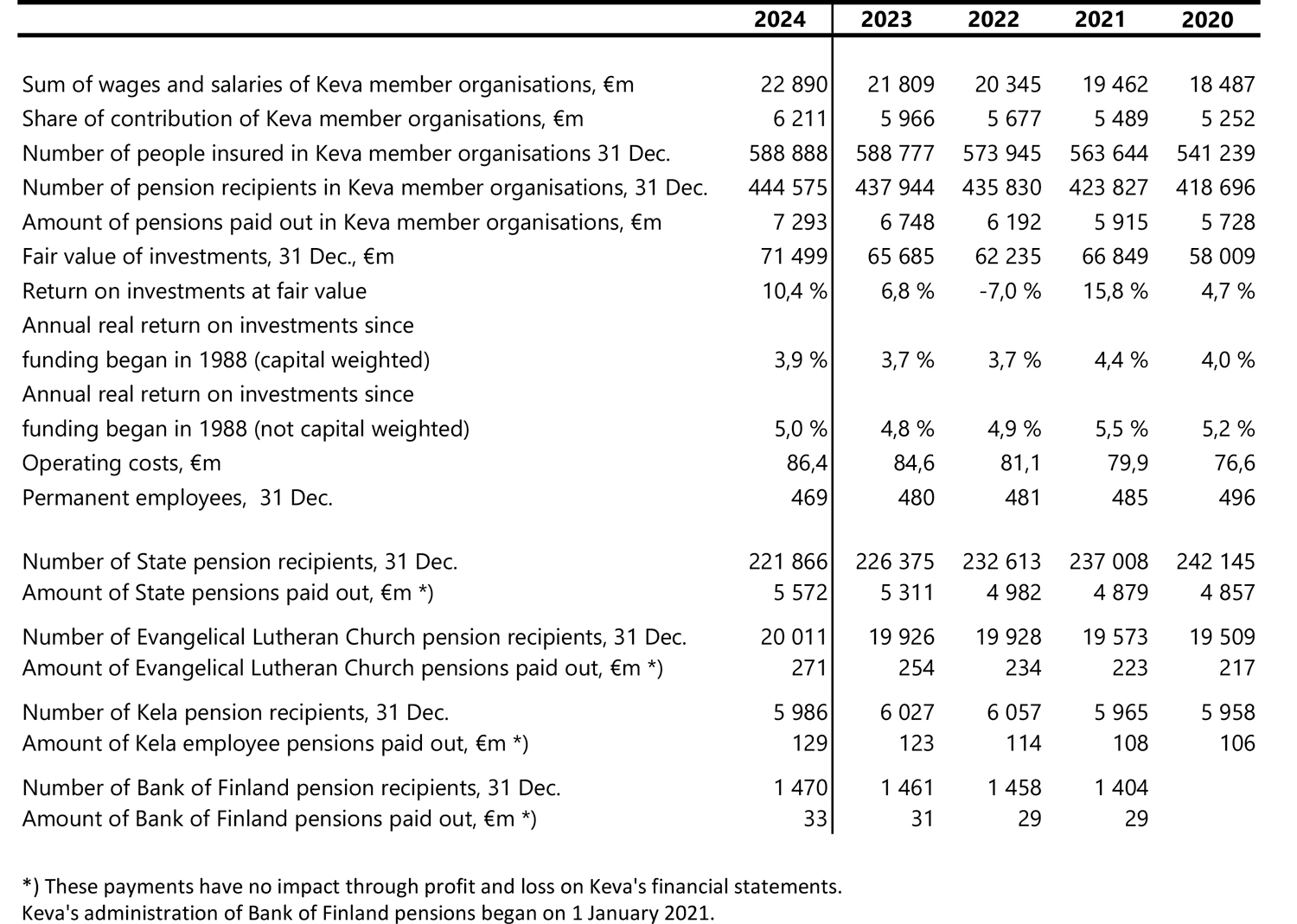

Keva, which is responsible for the funding of local government and wellbeing services county pensions and for the investment of pension funds, reported a total return on Keva’s investments at market value of 10.4% or EUR 6.7 billion for 2024.

Of Keva’s investment assets, the best performers were listed equities, which generated a return of 14.2%, hedge funds 12.7% and private equity investments 10.0%. Fixed income investments generated a return of 6.8% and real estate investments 1.8%.

Keva’s investment assets had a market value totalling EUR 71.5 billion at year-end 2024. Of this, listed equities accounted for 40.0%, fixed income investments 29.3%, private equity investments (including unlisted equities) 19.8%, hedge fund investments 6.9% and real estate investments for 6.7% of risk-based allocation. Derivatives had an impact of -2.7% on risk-based allocation.

Keva CEO Jaakko Kiander says that 2024 as a whole was a good year for Keva.

“Excellent investment performance resulted in an increase in the funding rate of the pensions for which we are responsible, besides which there was an improvement in the cost efficiency depicting our operations. Keva celebrated its 60th anniversary in high spirits,” he says.

CIO Ari Huotari says that market attention in 2024 was largely focused on central bank rate cuts and expectations of such cuts.

“Economic performance was subdued in Europe but much stronger in the USA, whereas there are mixed expectations for 2025. Equities saw another strong year in 2024, but going forward, geopolitical concerns and possible actions by the new US administration are casting a shadow over capital markets,” Huotari says.

Long-term investment performance still at a good level

Keva’s long-term return on investments has been at a good level. The cumulative capital-weighted real return on investments since funding began in 1988 to year-end 2024 was 3.9%. The average real return, excluding capital weighting, over the same period was 5.0%. The Finnish pension sector normally calculates long-term returns excluding capital weighting. Keva’s five-year real return excluding capital weighting has been 2.4% (nominal return 5.9%)and the ten-year return 3.7% (nominal return 5.8%).

Sum of wages and salaries of Keva member organisations increased

The sum of wages and salaries of Keva member organisations – towns and cities, municipalities, joint municipal authorities, municipal limited liability companies and wellbeing services counties – was EUR 22,9 billion, up 5% compared to 2023. A total of EUR 6.4 billion in contribution income accrued. Keva paid out EUR 7.3 billion in local government and wellbeing services county pensions. The gap between contribution income and pension expenditure was met out of investment income.

In 2024, Keva paid out pensions totalling EUR 6 billion to State, Evangelical Lutheran Church, Social Insurance Institution of Finland (Kela) and Bank of Finland personnel. The State, Church, Kela and Bank of Finland fund their own pensions and Keva’s investment assets are used solely to cover local government and wellbeing services county pensions.

Slight increase in total number of pension applications

Keva received a total of 3% more pension applications than in 2023. Partial early old-age pension applications rose by around 3,600 or 49% to reach around 10,900. This slightly exceeded the peak figures seen in 2022. Old-age and survivor pension applications were down 3-6%.

The number of applications for disability pensions, both full and partial disability pensions, was more or less unchanged compared to the previous year, whereas vocational rehabilitation applications were down 6% compared to 2023, with a particularly sharp fall seen in rehabilitation plan applications. Rehabilitation applications have been on a downward trajectory for many years now. Around 5,500 rehabilitation applications were received in 2024, whereas there were more than 8,100 in 2018.

In 2024, 65% of all pension applications in 2023 were made electronically in the Keva My Pension service. In addition to this, around 8% of pension applications arrived electronically via Keva, for example.

Keva processed old-age pensions in 3 days and disability pensions in 30 days on average. Partial early old-age pensions were processed fastest, with decisions issued in 2 days on average. Survivors’ pensions took an average of 6 days to process and rehabilitation decisions took an average of 18 days. Old-age, disability and survivors’ pensions were processed an average of 2-5 days faster than in private institutions.

For further information, please contact:

Jaakko Kiander, CEO, tel. +358 20 614 2201

Ari Huotari, CIO, tel. +358 20 614 2205

Piia Laaksonen, CFO and Chief Actuary, tel. +358 20 614 2371

Keva's key figures 2024

The figures in this release are preliminary and have not been subject to audit.

Keva’s financial statements, annual reports and interim reports are published on Financial information.

The report of the Board of Directors and financial statements will be published on our website after the meeting of Keva Councillors on 6 March.