We safeguard sustainable pension funding

Our mission is to ensure that the pension system of Keva’s member organisations is sufficient for future generations as well.

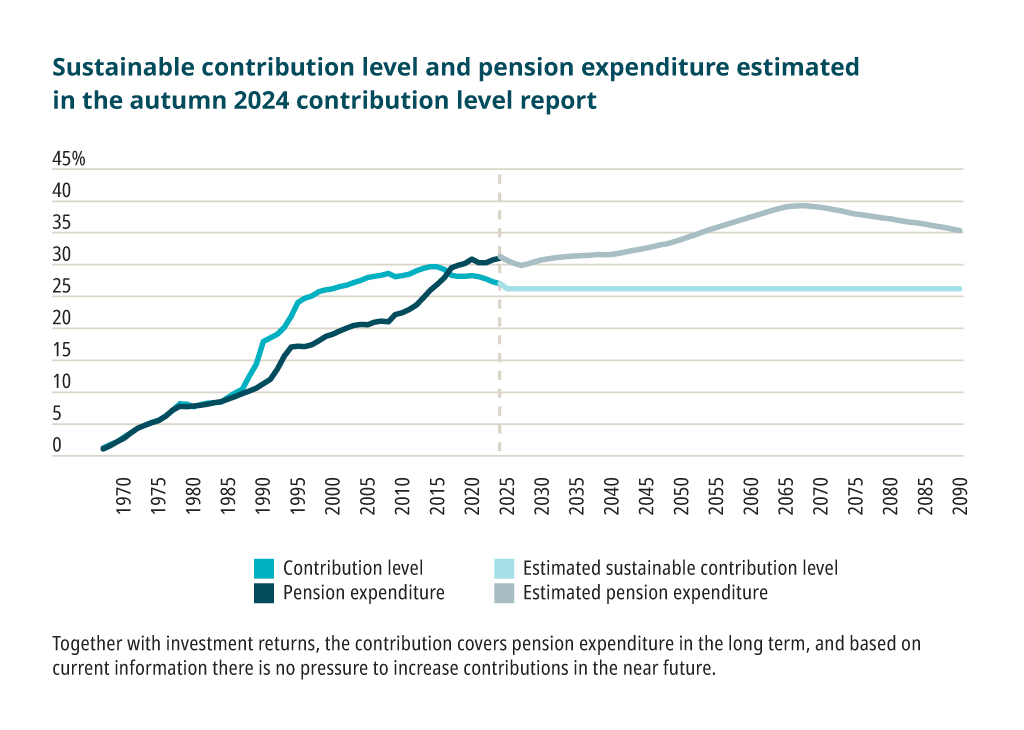

We aim for a stable level of contributions.

Financial sustainability requires real returns on investments, the pursuit of which requires bearing investment risk.

ESG criteria related to the environmental, social responsibility and good governance of investments provide a framework for examining long-term risks and opportunities.

Our investment operations are based on principlelevel documents, which are the Investment Beliefs and Responsible Investment Beliefs, adopted by the Board of Directors.

Keva's core mission

By law, Keva must carry out its financial-related tasks in a manner that secures pension benefits.

Keva’s strategy is based on a stable contribution level that secures pension benefits across generations.

In the light of current information, the funding of Keva’s pensions is sustainable in the long term at the current contribution level, and there will be no pressure to increase contributions in the near future.

Contribution level decided on the basis of reports Keva’s Councillors decide annually on the contributions payable by Keva member organisations on the proposal of Keva’s Board of Directors. The Ministry of Finance sets the balancing payment component and thus the overall level of contributions.

Higher risk level to increase investment returns

The pension expenditure of Keva’s member organisations’ pension system exceeded the contribution income in 2017, since when some pension expenditure has had to be funded out of investment returns. Financial sustainability therefore requires real returns on investments, the pursuit of which requires bearing an investment risk.

Going forward, the significance of investment returns in funding will increase as pension expenditure continues to grow faster than contribution income until the 2060s. However, pension contributions will continue to be the main source of pension funding for each year.

In summer 2023, Keva’s Board of Directors decided to increase the risk level of the investment portfolio.

Keva to increase Risk Level of Investment Portfolio

The decision was made toachieve higher long-term returns, which will contribute to securing the funding of future pensions. The higher risk level means the short-term return on investments will vary more than earlier.

Read more about Keva's investments