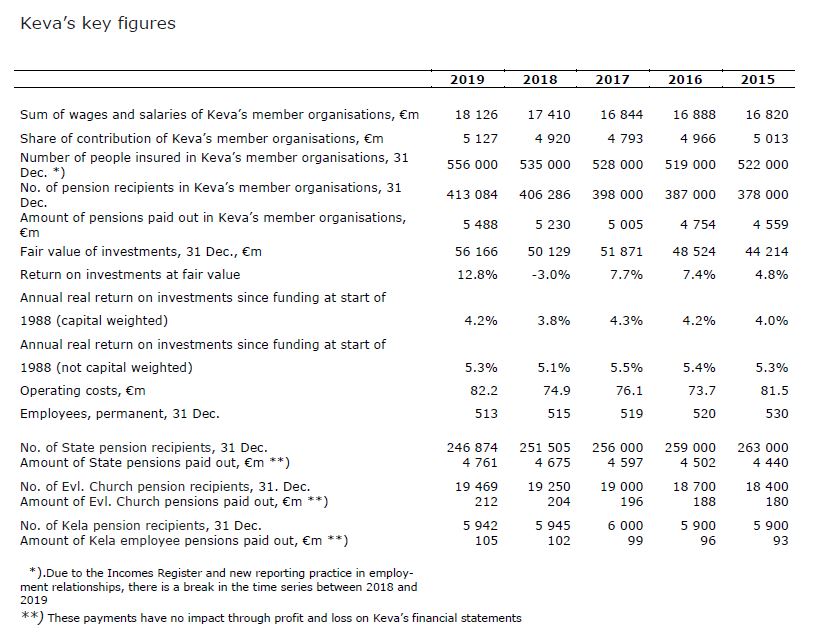

The year 2019 was the best investment year in Keva’s history in terms of euros: after costs, the total return on Keva’s investments at market value was 12.8% or EUR 6.4 billion. At year-end 2019, the pension fund was EUR 56 billion.

Of the investment assets, the best performers were listed equities 23.4%, pri-vate equity investments 11.1% and real estate investments 7.3%. The return on fixed income investments was 6.6% and on hedge funds 4.7%.

The investment assets of Keva, which is responsible for the funding of local government pensions and the investment of pension funds, had a market val-ue totalling EUR 56.2 billion at year-end 2019. Fixed income investments (in-cluding the impact of derivatives) accounted for 38.6% of the investment as-sets, listed equities for 37.7%, private equity investments (including unlisted equities) for 10.4%, hedge fund investments for 7.0% and real estate for 6.3%.

Keva CEO Timo Kietäväinen is delighted with the excellent result.

”All asset classes generated good returns last year to give Keva a record re-sult in terms of euros,” says Kietäväinen.

“We emphasise that the returns for one quarter or even for one year are not decisive. From the perspective of future earnings-related pensions, it is im-portant for investment returns to perform well long term and contribute to se-curing the funding of earnings-related pensions,” he adds.

Keva’s long-term return on investments has been excellent. The cumulative capital-weighted real return on investments since funding started in 1988 to year-end 2019 was 4.2% a year. The average real return, excluding capital weighting, over the same period was 5.3%.

The Finnish pension sector normally calculates long-term returns excluding capital weighting. Keva’s five-year real return excluding capital weighting has been 5.1% (nominal return 5.8%) and the ten-year return 5.4% (nominal re-turn 6.8%).

Keva Chief Investment Officer Ari Huotari says that all investors benefited from the strong rise of the equity markets on the one hand and the fall in in-terest rates on the other.

“The return on investment was certainly good given our very moderate in-vestment risk level,” Huotari highlights. “After this, it’s realistic to accept that as far as investment returns are concerned, expectations are lower than earli-er. You see, among other things, also the grandchildren’s interest income has already been cleared,” he points out.

Faster pension application processing times

Processing times of all pension types were shorter than a year earlier and Keva continues to have shorter processing times than average in the earn-ings-related pension sector. Keva processed old-age pensions in an average of 20 days and disability pensions in an average of 46 days. Processing times of partial early old-age pension applications were fastest, with decisions being is-sued in an average of seven days.

Timo Kietäväinen is pleased with the progress of reform at Keva and with good customer feedback. The good ratings in the reputation survey in particu-lar give cause for satisfaction.

“Under our new strategy, we aim to be the most efficient in the sector, to de-liver the best customer experience and for our investment operations to be at the top of sector,” he explains.

Online application growing in popularity

Last year, Keva received a total of some 69,500 pension and benefit applica-tions. The percentage of online applications rose to 47% (2018: 41%). Delays in the postal service later in the year added to the numbers of online applica-tions. Around 72% of old-age pension and 26% of disability pension applica-tions were made online.

The number of old-age pension applications fell by 9.5% because of a rise in the lower age for old-age pension. The popularity of early old-age pension ap-plications rose and there were 17% more applications than a year earlier.

The Incomes Register was brought into use at the beginning of 2019 and this caused changes in the processing of old-age pensions, for example. Employers had problems in reporting earnings and information concerning the end of employment relationships to the Incomes Register. This is why Keva had to resort to using the exceptional procedures to process old-age pensions under the back-up plan drawn up in 2018. By the early autumn, the worst of the problems were over even though errors resulting from the Incomes Register still had to be corrected towards the end of the year.

Increase in sum of wages and salaries in local government

The sum of wages and salaries of Keva member organisations - towns and cit-ies, municipalities, joint municipal authorities and municipal limited liability companies – grew by a total of 4.1% in 2019. A total of EUR 5.3 billion in con-tribution income accrued. Keva paid out EUR 5.5 billion in local government pensions. The difference between contribution income and pension expendi-ture was met out of investment income.

In 2019, Keva paid out pensions totalling EUR 5.1 billion to State, Evangelical Lutheran Church and Social Insurance Institution of Finland (Kela) personnel. The State, Church and Kela fund their own pensions and Keva’s investment assets are used solely to provide local government pensions.

Keva’s financial, annual and interim reports are published at www.keva.fi/tulostiedot. The Report of the Board of Directors and the finan-cial statements will be posted on our website after consideration by Keva’s Council on 5 March 2020.

For further information, please contact:

Timo Kietäväinen, CEO, tel. +358 20 614 2201

Ari Huotari, CIO, tel. +358 20 614 2205

Tom Kåla, CFO, tel. +358 20 614 2211